BVI: German fund industry is resilient in the market turbulence of 2022

- Spezialfonds and savings plans drive new business

- Asset decline: rebound in the last quarter

- Balanced funds and property funds with inflows, bond funds with outflows

- Equity funds: shift from European to global

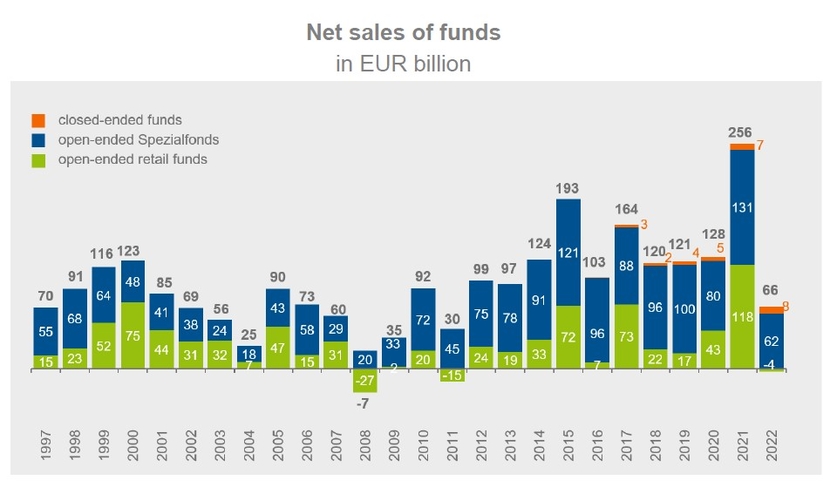

The German fund industry has shown itself to be resilient in the market turbulence of 2022. In total, EUR 66 billion flowed into funds. ‘Russia's invasion of Ukraine was a turning point,’ says Dirk Degenhardt, President of the German Investment Funds Association BVI. ‘The war, exploding energy prices and rising inflation rates led to significant declines in equity and bond markets and unsettled investors. Nevertheless, investors have reacted very cautiously and prudently, because we have not seen high outflows, but rather a reluctance to buy.’

Compared to other fund markets in Europe, new business in Germany is good, and the BVI’s President points not only to the inflows into Spezialfonds, which manage the capital of institutional investors. Fund savings plans are also increasingly supporting new business. ‘Initial signals for January business were good,’ says Degenhardt. ‘Looking forward, the completed turnaround in interest rates is also creating attractive prospects for bond funds again. However, based on the expected inflation rates, only equity and property funds or balanced and offensive balanced funds currently offer the chance of a positive real return.’

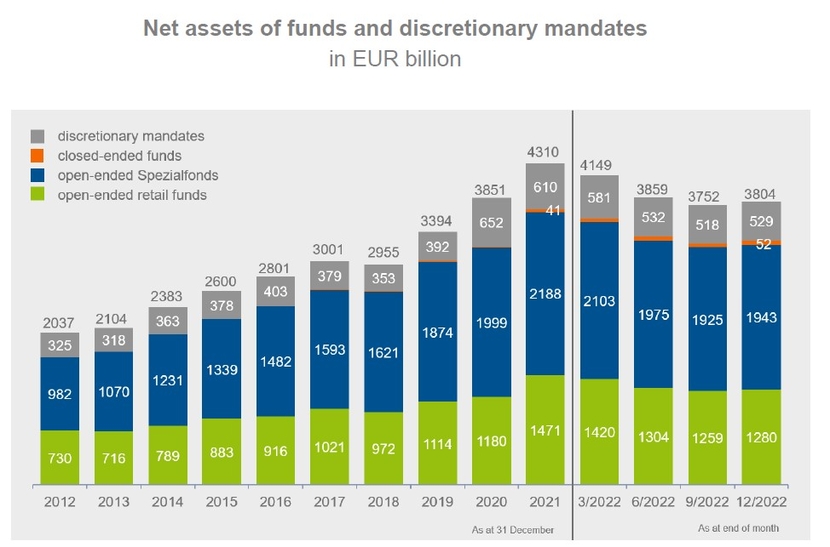

The development of the AuM reflects the turbulence on the equity markets. Fund companies managed total assets of EUR 3,804 billion at the end of 2022. This is almost 12 percent less than at the beginning of the year (EUR 4,310 billion). The downward trend stopped at the end of September and, due to the rebound on the equity markets, assets increased by one percent in the fourth quarter (30 September 2022: EUR 3,751 billion).

Open-ended Spezialfonds are the largest fund group with assets of EUR 1,943 billion. Together with discretionary mandates worth EUR 529 billion, almost two-thirds of the total AuM are attributable to purely institutional business with, for example, retirement benefit schemes or insurance companies.

Open-ended retail funds manage assets amounting to EUR 1,280 billion. The net assets of closed-end funds amount to EUR 52 billion.

The German fund market again confirmed its leading position in Europe. According to the European Central Bank, Germany is the largest fund market in the EU with a share of 28 percent. Germany is also leading in terms of growth. Within the last five years, assets in Germany increased by an average of 6.1 percent per year and, thus, growing significantly more than in other markets such as in Italy (2.5 percent per year) and France (1.4 percent per year).

Following the record start of Spezialfonds and retail funds in January 2022 with inflows totalling EUR 30 billion, the Ukraine war marked the turning point in new business. Open-ended retail funds saw a net outflow of EUR 4 billion in the full year. However, this is less than in the crisis years of 2008 (EUR 27 billion) and 2011 (EUR 15 billion). In the fourth quarter alone, retail funds recorded inflows of EUR 5 billion. Since 2020, according to the German Bundesbank a large part of the new business of retail funds comes from private savers. In 2022, they newly invested EUR 40 billion by the end of September – despite rising interest rates. An important factor in this development is fund savings plans, the number of which has risen strongly in recent years.

The net sales of retail funds shows a differentiated picture. Balanced funds received net inflows of EUR 12.5 billion in 2022. After a strong first quarter (EUR 13 billion), new business stagnated as the year proceeded. New business also declined for property funds over the year. In total, they generated EUR 4.5 billion in new money. Bond funds recorded outflows of EUR 17.4 billion – led by bond funds with a focus on the euro or European currencies (EUR 9 billion in total) and corporate bond funds (EUR 2 billion). In terms of equity funds, products with a global investment focus were in demand, they recorded EUR 20 billion. Investors withdrew a total of EUR11 billion from funds that invest across Europe. North America funds recorded outflows of EUR 3.5 billion, emerging market funds lost EUR 2.5 billion. All in all, equity funds recorded inflows of EUR 0.5 billion. This included outflows of EUR 4.4 billion from equity ETFs.

Inflows in retail funds with sustainability features

Retail funds with sustainability features were able to decouple partially from the difficult market situation. Products that fund companies have classified under Article 8 or Article 9 of the EU Disclosure Regulation (SFDR) received net new money of EUR 5.4 billion. They manage assets of EUR 604 billion. That is 20 percent more than at the end of the previous year (EUR 503 billion). The increase is mainly explained by the shift from conventional funds to funds that meet the relevant transparency requirements of the EU under Article 8 or 9 of the SFDR. Open-ended Spezialfonds with sustainability features manage EUR 135 billion.

Spezialfonds: retirement benefit schemes top the sales list

Open-ended Spezialfonds received a total of EUR 62 billion in new money. Of this, EUR 56 billion came from retirement benefit schemes and, thus, more than in the previous year when they already topped the sales list with EUR 37 billion. With EUR 669 billion in Spezialfonds, retirement benefit schemes are also the largest investor group by volume, followed by insurance companies with EUR 528 billion.